Execution Confidentiality across Borders

Navigating the intricate landscape of global financial markets presents a unique challenge for institutional principals. The task involves executing substantial block trades without inadvertently signaling intentions to the broader market, all while adhering to diverse jurisdictional mandates. This operational imperative necessitates a sophisticated technological overlay, a digital nervous system designed for both stealth and compliance. It is about deploying an architectural framework that allows for the precise, unobserved movement of significant capital across varied regulatory terrains.

Consider the fundamental tension inherent in large-scale trading ▴ public markets, while offering transparency, simultaneously expose significant orders to predatory algorithms and information arbitrage. Such exposure leads to detrimental price slippage and adverse selection, eroding alpha and diminishing capital efficiency. The systemic response to this challenge involves creating private, controlled environments where large orders can meet liquidity with minimal footprint. These environments, underpinned by advanced technological integrations, extend their reach across national boundaries, harmonizing disparate market rules into a cohesive execution strategy.

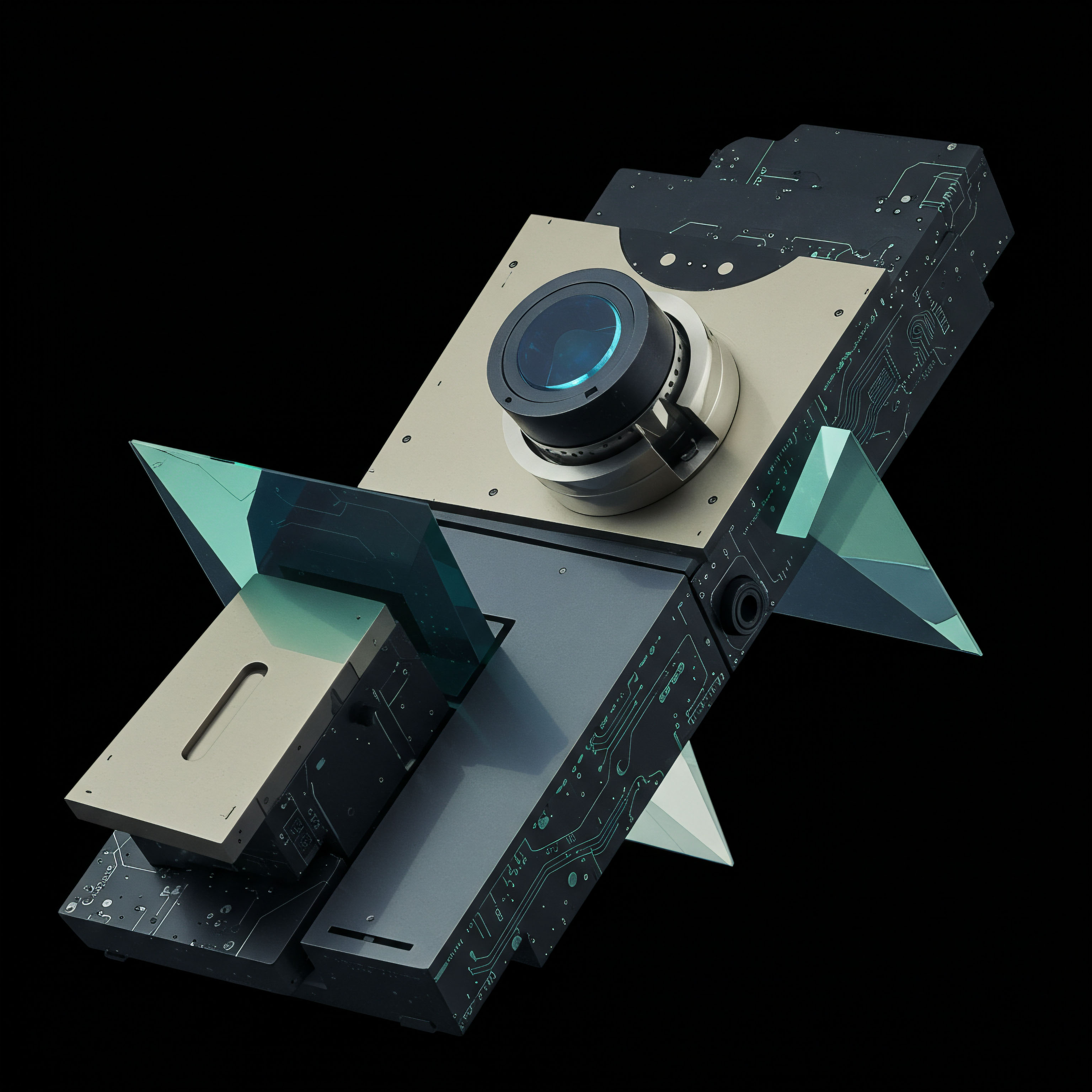

Discreet multi-jurisdictional block trade execution requires a sophisticated technological framework to navigate global markets with minimal information leakage.

The genesis of this capability lies in a deep understanding of market microstructure and the strategic application of computational power. Modern systems provide mechanisms for participants to interact with liquidity providers in a shielded manner, ensuring that the intent to trade a large volume does not become a market-moving event in itself. This protective layer is paramount for maintaining the integrity of an investment strategy, particularly when dealing with illiquid assets or highly sensitive positions. The objective extends beyond simply finding a counterparty; it encompasses the strategic containment of market impact.

An effective system for discreet multi-jurisdictional block trade execution must address several core tenets. First, it must provide robust mechanisms for order anonymity, ensuring that the identity of the trading entity and the precise details of their order remain undisclosed until execution. Second, it requires adaptable compliance modules that can dynamically interpret and apply regulatory requirements across various legal domains, from data privacy to trade reporting.

Third, the underlying infrastructure must support seamless, high-speed connectivity to a diverse array of liquidity sources, encompassing both traditional and alternative trading venues. The convergence of these elements forms the bedrock of a truly effective multi-jurisdictional block trading platform.

The complexity intensifies when considering the varied market structures globally. Different regions impose unique reporting obligations, pre-trade transparency rules, and settlement procedures. A singular, integrated platform must therefore abstract away this underlying complexity, presenting a unified operational interface to the institutional trader.

This abstraction layer is a testament to sophisticated system design, allowing a portfolio manager to focus on strategic objectives rather than the minutiae of localized compliance. It transforms a fragmented global market into a coherent, navigable ecosystem for block liquidity.

Strategic Liquidity Orchestration

Achieving optimal block trade execution across multiple jurisdictions demands a meticulously crafted strategic framework, one that prioritizes discretion, efficiency, and regulatory adherence. The cornerstone of this strategy involves intelligent liquidity orchestration, leveraging specialized trading protocols and venues to minimize market impact. The goal is to source significant liquidity while preserving the anonymity of the order, thereby shielding it from adverse price movements and opportunistic trading strategies.

Request for Quote Protocols

Request for Quote (RFQ) protocols stand as a primary strategic tool for institutional traders executing large, complex, or illiquid transactions. This mechanism facilitates bilateral price discovery, enabling a buyer to solicit price quotes from multiple liquidity providers in a private, competitive environment. The trader enters desired trade details ▴ asset, amount, and direction ▴ which are then distributed to a curated list of pre-approved counterparties.

Each provider evaluates the request and responds with their best offer, allowing the trader to select the most favorable quote. This process occurs off-book, meaning trade intentions remain confidential, mitigating the risk of information leakage and preventing front-running or sudden price shifts.

The strategic advantage of RFQ systems lies in their capacity to create a competitive dynamic among liquidity providers without exposing the full order size to the public market. This approach is particularly effective for illiquid assets, such as fixed income instruments or certain derivatives, where public order books might not offer sufficient depth to absorb a large block without significant price erosion. By engaging multiple dealers simultaneously, RFQ platforms promote price improvement and enhance execution quality, translating directly into improved capital efficiency for the institutional client.

RFQ protocols enable private, competitive price discovery for large trades, minimizing market impact and preserving order confidentiality.

The integration of RFQ mechanisms within broader trading platforms extends their strategic utility. Firms often integrate these tools with their Order Management Systems (OMS) to streamline workflows and capture comprehensive audit trails for best execution analysis. This holistic integration ensures that the entire lifecycle of an RFQ-driven block trade, from initiation to settlement, is managed within a cohesive operational architecture. Such systemic coherence is vital for institutional participants, providing the necessary control and transparency for regulatory scrutiny.

Non-Displayed Liquidity Venues

Non-displayed liquidity venues, commonly known as dark pools, constitute another critical strategic component for discreet block trade execution. These private exchanges match buy and sell orders without revealing order information to market participants until after the trade is complete. Dark pools emerged as a response to the challenges posed by increasing market transparency, particularly the exploitation of large institutional orders by high-frequency trading algorithms. Their core function involves reducing market impact and preventing price slippage by concealing trading intentions.

The strategic deployment of dark pools allows institutional investors to execute substantial blocks of securities anonymously, preventing major market impacts and protecting against price devaluation. Sophisticated dark pools employ various techniques to prevent information leakage, including order size randomization, execution timing delays, and rigorous participant screening to exclude potentially toxic order flow. This layered approach to discretion provides a secure environment for large orders to interact with hidden liquidity.

While traditional dark pools primarily focused on equity trading, newer platforms have expanded to include fixed income, foreign exchange, and derivatives, creating opportunities for more sophisticated portfolio-level trading strategies. The expansion into multi-asset dark pools underscores a strategic evolution, allowing institutional investors to manage diverse portfolios with consistent anonymity benefits. The ability to access this hidden liquidity across various asset classes within a unified framework represents a significant strategic advantage, offering flexibility in portfolio rebalancing and risk management.

Navigating Jurisdictional Nuances

A multi-jurisdictional block trade strategy must inherently account for the disparate regulatory landscapes governing global markets. Each jurisdiction may impose unique requirements concerning trade reporting, market surveillance, and data residency. Strategic planning involves selecting trading venues and technological partners that demonstrate robust capabilities in cross-border compliance. This includes platforms that can dynamically adapt their execution logic to local rules, ensuring that discretion does not compromise regulatory integrity.

The strategic interplay between RFQ systems and dark pools becomes particularly salient in a multi-jurisdictional context. An RFQ system, for instance, can be configured to solicit quotes only from liquidity providers authorized to operate within specific regulatory boundaries, thereby ensuring compliance with local licensing and counterparty eligibility rules. Similarly, dark pools operating across borders must implement internal controls and data architectures that segregate and process information according to the originating jurisdiction’s requirements. This complex operational tapestry ensures legal and ethical execution across diverse market ecosystems.

A forward-looking strategy also considers the evolving technological frontier, particularly the potential of distributed ledger technology (DLT) for enhanced transparency and efficiency in cross-border settlements, without sacrificing discretion at the point of trade execution. While DLT primarily impacts post-trade processes, its underlying principles of secure, immutable record-keeping could eventually influence pre-trade information sharing and regulatory reporting, offering new avenues for streamlined multi-jurisdictional operations.

- Discretionary Sourcing ▴ Employing RFQ systems to privately solicit quotes from multiple liquidity providers, maintaining confidentiality.

- Non-Displayed Execution ▴ Utilizing dark pools to match large orders away from public view, minimizing market impact.

- Regulatory Adaptability ▴ Configuring trading platforms to dynamically adhere to diverse jurisdictional compliance requirements.

- Integrated Workflow ▴ Connecting RFQ and dark pool mechanisms with OMS/EMS for seamless trade lifecycle management and auditability.

- Multi-Asset Reach ▴ Expanding discreet execution capabilities across various asset classes, from equities to derivatives and fixed income.

Operationalizing Global Block Trades

The meticulous execution of discreet multi-jurisdictional block trades requires a robust operational architecture, integrating advanced technological components to ensure precision, speed, and unwavering compliance. This phase moves beyond conceptual understanding and strategic intent, delving into the precise mechanics that enable high-fidelity execution across fragmented global markets.

Connectivity and Protocol Standards

The Financial Information eXchange (FIX) protocol stands as the lingua franca of electronic trading, forming the backbone of inter-system communication for institutional participants. FIX messages facilitate the seamless exchange of order and execution information between buy-side firms, sell-side brokers, and trading venues. For block trades, specific FIX tags convey critical details, including order type, handling instructions, and trade capacity, enabling precise control over execution parameters. The protocol supports various trade types, with explicit identifiers for “Block Trade” (TrdType=1) and “Privately Negotiated Trade” (TrdType=22), ensuring proper classification and processing across diverse systems.

FIX protocol serves as the indispensable communication standard, enabling precise control and seamless information exchange for block trade execution across trading counterparties.

In a multi-jurisdictional context, FIX’s standardized messaging is invaluable. It allows different market participants in various regions to communicate trade instructions and execution reports uniformly, abstracting away underlying system disparities. This global interoperability is fundamental for routing block orders to optimal liquidity pools, whether they reside in London, New York, or Singapore, while maintaining a consistent data structure for reporting and analysis. The continuous evolution of FIX ensures it remains adaptable to new market structures and regulatory mandates, providing a resilient foundation for cross-border operations.

Order and Execution Management Systems

Order Management Systems (OMS) and Execution Management Systems (EMS), often integrated into a unified OEMS, form the central nervous system for institutional trading desks. These platforms manage the entire lifecycle of a trade, from order creation and routing to execution and post-trade allocation. For discreet multi-jurisdictional block trades, an OEMS provides the critical capabilities for:

- Multi-Asset Support ▴ Handling diverse asset classes, including equities, fixed income, foreign exchange, and derivatives, across various global markets.

- Smart Order Routing (SOR) ▴ Dynamically directing block orders to the most suitable liquidity venues ▴ be it an RFQ system, a dark pool, or a regulated exchange ▴ based on predefined criteria such as price, liquidity, and discretion requirements.

- Pre-Trade Compliance ▴ Conducting real-time checks against regulatory rules, internal limits, and counterparty eligibility across multiple jurisdictions before an order is placed.

- Automated Allocations ▴ Streamlining the process of allocating executed block trades to multiple client portfolios, reducing operational risk and ensuring accuracy.

The integration of an OEMS with global connectivity networks, often leveraging FIX, provides direct access to hundreds of liquidity venues and sell-side brokers worldwide. This extensive reach is paramount for sourcing the deep liquidity required for block trades while simultaneously enabling the flexibility to adapt to local market conditions and regulatory frameworks. The ability to manage list and portfolio execution strategies, monitor compliance throughout the trade lifecycle, and visualize broker eligibility checks within a single platform enhances operational control and efficiency.

Block Order Routing Workflow

The process of routing a block order for discreet, multi-jurisdictional execution involves a sophisticated series of steps, meticulously managed by the OEMS.

- Order Initiation ▴ A portfolio manager generates a large order, specifying asset, quantity, and direction. The OEMS captures this intent.

- Pre-Trade Analytics ▴ The system analyzes market conditions, estimated market impact, and available liquidity across various venues, both lit and dark, in relevant jurisdictions.

- Compliance Check ▴ Automated checks against internal policies, regulatory limits (e.g. MiFID II block size thresholds), and sanctions lists are performed instantaneously.

- Venue Selection ▴ Based on discretion requirements and liquidity analysis, the OEMS determines the optimal venue(s) for execution. This might involve an RFQ system for private price discovery or a dark pool for non-displayed matching.

- Order Transmission (FIX) ▴ The order, with appropriate handling instructions and anonymity flags, is transmitted via FIX protocol to selected liquidity providers or venues.

- Execution Management ▴ The EMS component actively manages the order, potentially breaking it into smaller child orders (iceberg orders) to minimize footprint, while continuously monitoring market conditions and execution quality.

- Real-Time Monitoring ▴ Traders monitor execution progress, slippage, and market impact through real-time dashboards provided by the OEMS.

- Post-Trade Reporting ▴ Upon execution, the OEMS generates detailed execution reports, facilitating Transaction Cost Analysis (TCA) and regulatory reporting across all applicable jurisdictions.

- Allocation and Settlement ▴ The system automates the allocation of executed shares to client accounts and initiates settlement processes, again adhering to jurisdictional requirements.

The following table illustrates key OEMS capabilities crucial for discreet multi-jurisdictional block trade execution:

| Capability Area | Key Features for Block Trades | Discretion / Multi-Jurisdictional Impact |

|---|---|---|

| Order Aggregation | Consolidates multiple client orders into a single block. | Reduces individual order footprint, enhancing discretion. |

| Venue Agnosticism | Routes to exchanges, dark pools, SIs, RFQ platforms. | Optimizes liquidity access across diverse global venues. |

| Anonymity Control | Masks order size, client identity, and trading intent. | Prevents information leakage and adverse price movements. |

| Compliance Automation | Pre-trade and post-trade checks for regulatory adherence. | Ensures legal execution across varying global regulations. |

| Algorithmic Execution | Uses smart algorithms (e.g. VWAP, TWAP, Iceberg) for large orders. | Minimizes market impact and optimizes execution over time. |

| Real-Time Analytics | Monitors market impact, slippage, and execution quality. | Provides immediate feedback for tactical adjustments. |

Regulatory Technology and Cross-Border Compliance

The complexity of multi-jurisdictional trading is amplified by the diverse and evolving regulatory landscape. Regulatory Technology (RegTech) solutions are indispensable for ensuring compliance in cross-border block trade execution. These technologies leverage artificial intelligence (AI), machine learning (ML), and automated workflows to streamline compliance processes, reducing costs and enhancing accuracy.

For global block trades, RegTech facilitates several critical functions:

- Automated Sanctions Screening ▴ Real-time checks against global sanctions lists, ensuring that counterparties and jurisdictions involved in a trade are permissible.

- Anti-Money Laundering (AML) / Know Your Customer (KYC) ▴ Utilizing AI and behavioral analytics to monitor transactions for suspicious activity and verify client identities, crucial for preventing illicit financial flows across borders.

- Trade Reporting Automation ▴ Automatically generating and submitting trade reports to relevant regulatory bodies in each jurisdiction, adhering to specific formats and timelines (e.g. MiFID II, Dodd-Frank).

- Data Residency and Privacy Management ▴ Ensuring that sensitive trade and client data are stored and processed in compliance with local data protection laws, such as GDPR.

RegTech platforms integrate with OEMS and other trading infrastructure components, providing a continuous compliance layer throughout the trade lifecycle. This proactive approach helps firms stay ahead of regulatory changes, using predictive analytics to anticipate shifts in compliance requirements. The ultimate benefit is a reduction in regulatory risk and the avoidance of significant fines, transforming compliance from a burden into an operational advantage.

A particular challenge involves navigating scenarios where one country demands access to data while another prohibits its sharing. Companies must address this dichotomy through robust data governance frameworks and potentially localized cloud solutions that offer sovereign controls. This intricate dance between data access and protection underscores the profound importance of a meticulously designed RegTech strategy in facilitating truly discreet and compliant multi-jurisdictional block trade execution.

References

- techbuzzireland.com. “What Is a Block RFQ Tool?” (2025).

- Traders Magazine. “RFQ Trading Unlocks Institutional ETF Growth.” (2016).

- The TRADE. “Request for quote in equities ▴ Under the hood.” (2019).

- Tradeweb. “U.S. Institutional ETF Execution ▴ The Rise of RFQ Trading.” (2016).

- EDMA Europe. “The Value of RFQ Executive summary In the ongoing search for liquidity and delivering value to their clients, insti.”

- Verified Investing. “Dark Pools ▴ Hidden Markets Moving Billions in Daily Trading Volume.” (2025).

- Investopedia. “Inside Dark Pools ▴ How They Work and Why They’re Controversial.”

- Tiger Research Reports. “The inevitability of decentralized dark pools.” (2024).

- Medium. “Unveiling the Shadows ▴ An Introduction to Alternative Trading Systems and Dark Pools in Institutional Trading.” (2025).

- Hedgeweek. “Dark Pools deliver price improvement and anonymity.” (2013).

- FIXtelligent. “A Trader’s Guide to the FIX Protocol.”

- TT FIX Help and Tutorials. “Execution Report (8) Message.”

- OnixS. “FIX 5.0 SP2 EP292 ▴ TrdType <828> field ▴ FIX Dictionary.”

- Limina IMS. “Trade Order Management System (OMS).”

- United Fintech. “Order Management Systems (OMS) and their purpose.”

- INDATA iPM. “Order Management System vs. Execution Management System ▴ What’s the Difference?” (2025).

- Fynd. “What is an Order Execution Management System (OEMS) Trading?” (2024).

- Charles River Development. “Order and Execution Management OEMS Trading.”

- BlockStand. “Regulatory compliance and Governance Model for cross-border payments using blockchain technology.” (2024).

- Eastnets. “Navigating Regulatory Compliance in Trade Finance ▴ Best Practices for Banks.” (2024).

- McKinsey. “Boards are calling for more digital autonomy ▴ How CIOs can deliver.” (2025).

- Phoenix Strategy Group. “Ultimate Guide to RegTech for Cross-Border AML.” (2025).

- Michael Edwards. “Cross-Border Banking Transactions ▴ Legal Implications and Strategies.”

Beyond Transactional Horizons

Reflecting upon the sophisticated interplay of technology and market dynamics in discreet multi-jurisdictional block trade execution reveals a fundamental truth ▴ mastery in this domain stems from an architectural mindset. The capabilities discussed, from RFQ protocols to integrated OEMS and advanced RegTech, are not merely isolated tools; they represent interconnected modules within a larger, cohesive operational system. A principal’s ability to achieve superior execution and capital efficiency hinges on understanding this systemic whole, discerning how each component contributes to a resilient, compliant, and ultimately, advantageous trading framework.

The constant evolution of market microstructure and regulatory demands compels continuous introspection into one’s own operational framework. Is your current system truly optimizing for discretion while navigating global complexities, or does it inadvertently introduce points of information leakage or compliance vulnerability? The strategic edge belongs to those who view their trading infrastructure as a dynamic, living entity, capable of adaptation and refinement. This pursuit of an optimized operational architecture is an ongoing journey, one that consistently seeks to translate complex market mechanisms into decisive strategic advantages.

Consider the sheer computational power now available, offering unprecedented opportunities for predictive analytics and real-time risk assessment. The systems architect within each institution must continually evaluate how these advancements can be integrated to further enhance discretion and multi-jurisdictional reach. The objective extends beyond simply executing a trade; it involves shaping the very environment in which trades occur, ensuring that every interaction with global liquidity is controlled, confidential, and strategically sound.

The imperative is clear ▴ cultivating an operational framework that not only responds to market demands but proactively anticipates them. This level of foresight and systemic control empowers principals to transcend transactional thinking, focusing instead on the enduring architectural integrity that underpins consistent alpha generation.

Glossary

Block Trades

Capital Efficiency

Market Microstructure

Liquidity Providers

Discreet Multi-Jurisdictional Block Trade Execution

Across Various

Multi-Jurisdictional Block

Block Trade Execution

Market Impact

Information Leakage

Order Management Systems

Block Trade

Trade Execution

Dark Pools

Multi-Jurisdictional Block Trade

Execution Across

Discreet Multi-Jurisdictional Block

Discreet Multi-Jurisdictional

Execution Management Systems

Smart Order Routing

Fix Protocol

Execution Management

Transaction Cost Analysis

Multi-Jurisdictional Block Trade Execution

Regulatory Technology

Discreet Multi-Jurisdictional Block Trade