Navigating Global Liquidity Channels

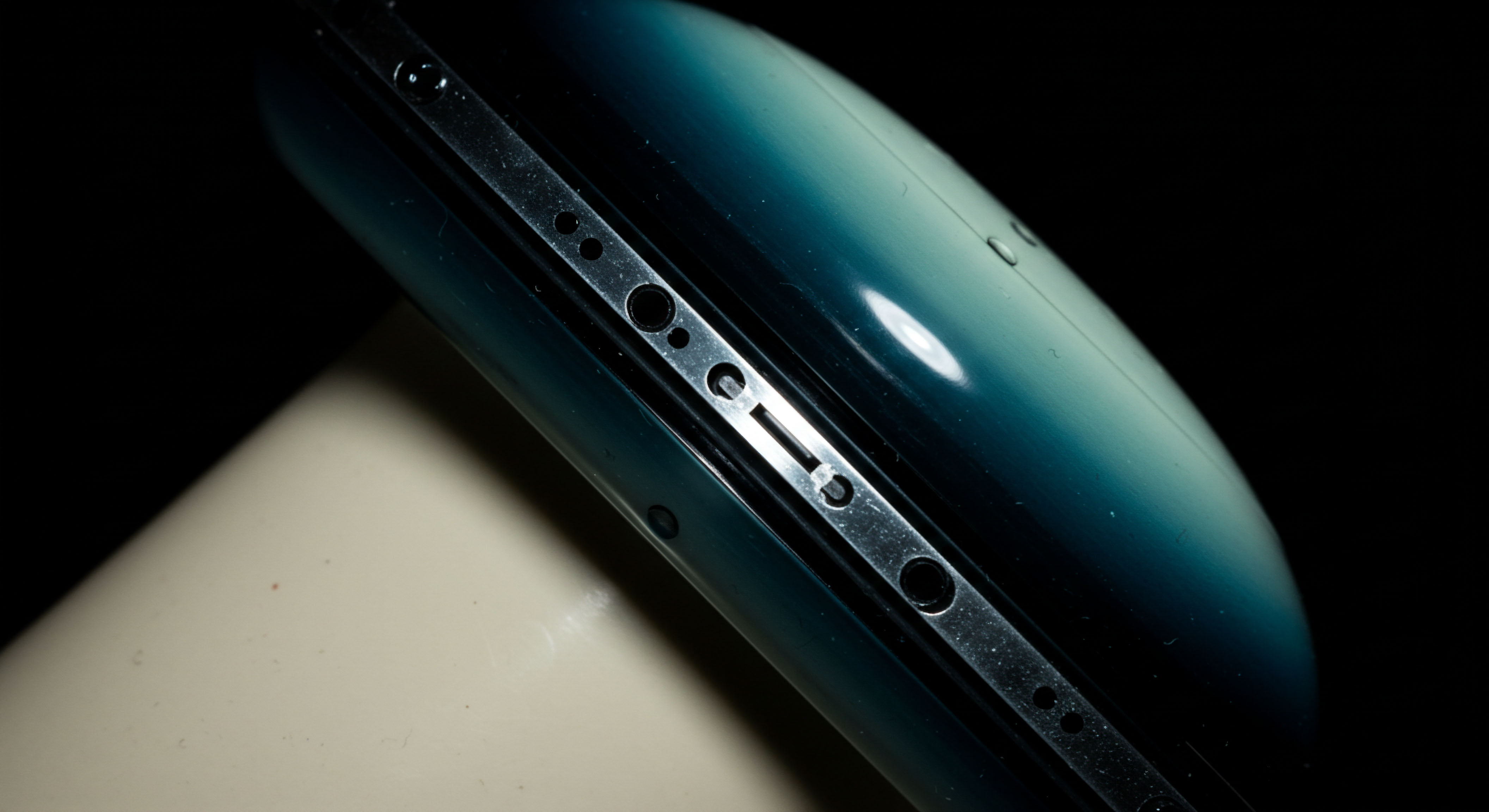

The intricate dance of capital across sovereign boundaries, particularly when orchestrating substantial block trades, demands an operational architecture of unparalleled sophistication. Seasoned professionals understand that simply identifying liquidity is insufficient; the true challenge resides in the seamless, compliant movement of that liquidity from intent to execution. The very notion of a “seamless” cross-border block trade conjures images of frictionless capital flow, yet the reality involves a complex interplay of jurisdictional mandates, disparate technological stacks, and the omnipresent specter of operational friction. The quest for superior execution, therefore, becomes an exercise in systemic engineering, requiring a deep understanding of how technology can bridge geographical and regulatory divides.

Achieving this fluidity requires a deliberate integration of technological components that address not only the mechanics of trade but also the rigorous demands of global regulatory frameworks. A fundamental shift in perspective occurs when viewing these integrations not as disparate tools, but as interconnected modules within a unified operational system. This system must inherently possess the capacity for high-fidelity execution, ensuring that large-scale transactions occur with minimal market impact. The digital asset space, with its inherent global nature and nascent market structures, amplifies these considerations, presenting both unprecedented opportunities and magnified complexities for institutional participants.

The core of this systemic approach involves several layers of technological enablement. At the foundational level, distributed ledger technologies offer a transformative potential for creating shared, immutable records across jurisdictions. This underlying infrastructure can significantly streamline the post-trade landscape, reducing reconciliation burdens and enhancing transparency for all involved parties. Beyond the ledger, sophisticated communication protocols become the conduits for orchestrating complex trade sequences, allowing for discreet price discovery and secure information exchange among multiple counterparties.

Effective cross-border block trade execution necessitates a unified operational system where technology bridges geographical and regulatory complexities.

Furthermore, the intelligence layer, comprising real-time data analytics and robust risk management systems, provides the necessary oversight to navigate volatile markets and ensure compliance. These integrated systems work in concert to transform what was once a cumbersome, opaque process into a controlled, efficient, and auditable operation. The imperative for institutional players remains clear ▴ to master these technological integrations and thereby unlock a decisive edge in the global arena.

Architecting Strategic Capital Deployment

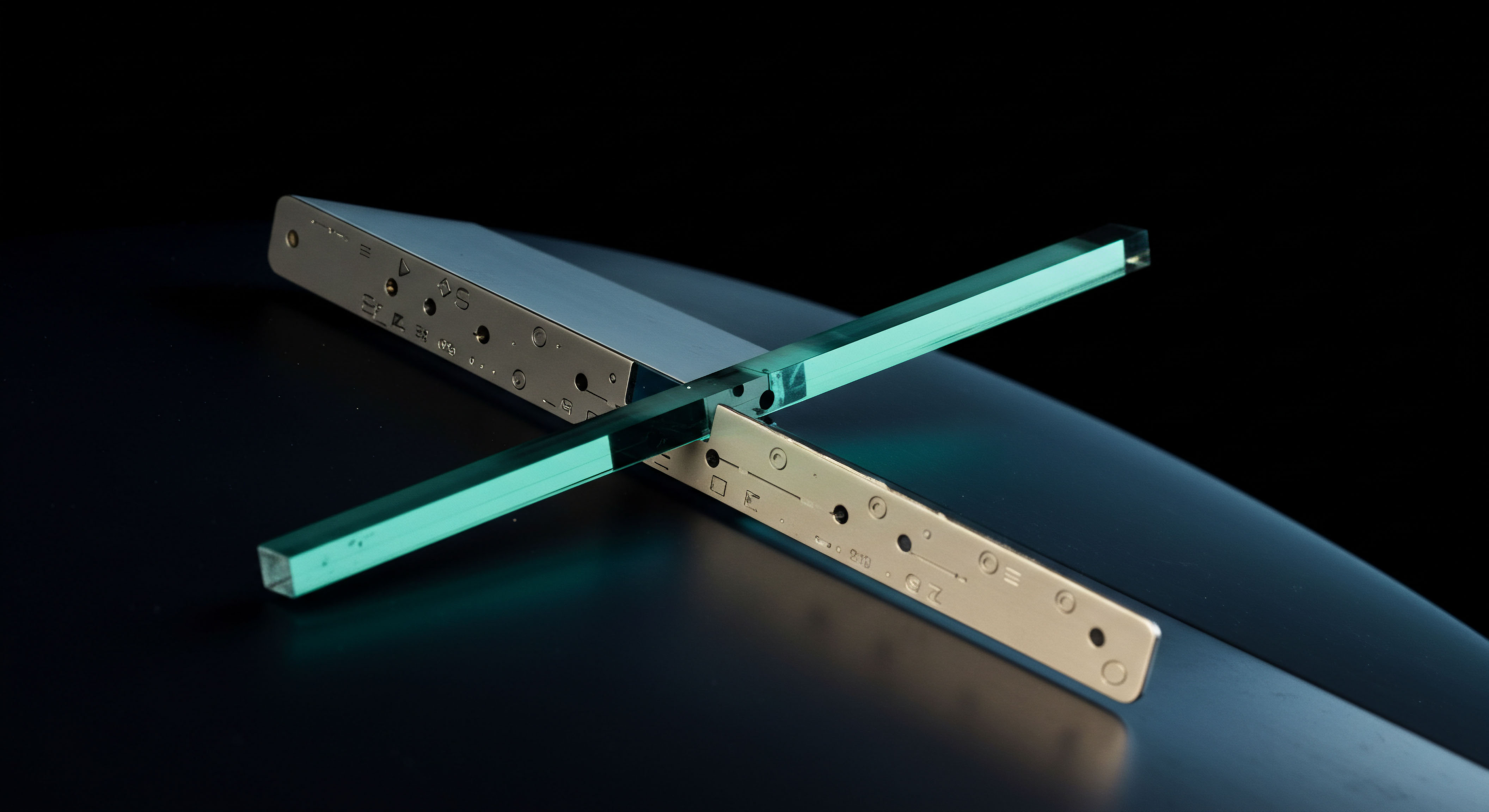

Crafting a strategic framework for cross-border block trade execution requires a meticulous understanding of the available technological levers. The objective centers on optimizing capital efficiency while rigorously adhering to compliance mandates across diverse legal landscapes. Institutional participants prioritize robust mechanisms for price discovery, liquidity aggregation, and discreet execution, particularly when dealing with substantial order sizes that could otherwise disrupt market equilibrium. The strategic deployment of technology directly addresses these core requirements, transforming potential liabilities into sources of operational advantage.

A primary strategic gateway involves the evolution of Request for Quote (RFQ) mechanics. Traditional RFQ systems, while foundational, often face limitations in a cross-border, multi-asset environment. The modern approach involves high-fidelity execution protocols within RFQ systems, designed to handle multi-leg spreads and complex derivatives.

These advanced RFQ platforms facilitate bilateral price discovery, enabling institutions to solicit quotes from a curated pool of liquidity providers across different geographical locations without revealing their full order intent to the broader market. This discreet protocol minimizes information leakage, a critical concern for large block trades.

System-level resource management becomes paramount in this context, with platforms aggregating inquiries and optimizing the allocation of capital across various venues. The ability to source off-book liquidity through these enhanced RFQ channels significantly reduces slippage, preserving the intended economic value of the trade. This strategic choice provides a direct path to best execution, a regulatory obligation and a competitive differentiator.

Strategic capital deployment leverages advanced RFQ mechanics and systemic resource management to achieve optimal execution and mitigate market impact.

Beyond RFQ, advanced trading applications offer sophisticated tools for managing risk and automating complex strategies. Consider the mechanics of synthetic knock-in options or automated delta hedging (DDH). These applications, often built upon a flexible API architecture, allow portfolio managers to define precise risk parameters and execute multi-leg strategies with programmatic precision.

The strategic advantage here stems from the ability to respond to market shifts with algorithmic speed and consistency, reducing manual intervention and its associated risks. For example, a global macro fund might employ an automated delta hedging strategy across various digital asset exchanges, requiring seamless integration and real-time data feeds from each venue.

The intelligence layer provides the crucial connective tissue, transforming raw market data into actionable insights. Real-time intelligence feeds, offering granular market flow data and order book dynamics, allow traders to anticipate liquidity shifts and optimize their execution timing. This analytical capability is complemented by expert human oversight, where system specialists monitor algorithmic performance and intervene in anomalous situations. The strategic synthesis of automated systems with informed human judgment forms a resilient operational defense.

Implementing these strategic integrations often involves a tiered approach, beginning with foundational data standardization and progressing to complex algorithmic execution. The table below illustrates a comparative view of strategic objectives and their corresponding technological enablers ▴

| Strategic Objective | Core Challenge Addressed | Primary Technological Enabler | Key Benefit |

|---|---|---|---|

| Discreet Price Discovery | Information leakage, market impact | Enhanced RFQ platforms with private quotation protocols | Reduced slippage, preserved alpha |

| Liquidity Aggregation | Fragmented liquidity, best execution compliance | Multi-dealer liquidity networks, smart order routing | Optimized execution price, access to deep pools |

| Automated Risk Management | Volatile markets, manual error potential | Algorithmic hedging, advanced order types | Consistent risk control, reduced operational risk |

| Regulatory Transparency | Cross-jurisdictional reporting, audit trails | Distributed ledger technology, immutable record-keeping | Streamlined compliance, enhanced auditability |

| Operational Efficiency | Manual reconciliation, high transaction costs | Standardized communication protocols (e.g. FIX) | Reduced processing times, lower operational overhead |

Each element within this strategic architecture contributes to a cohesive system designed to manage the complexities inherent in global block trading. The focus remains on building a resilient, adaptable framework that can withstand market volatility and evolving regulatory landscapes, securing a structural advantage for institutional players.

Precision Orchestration for Global Transaction Flows

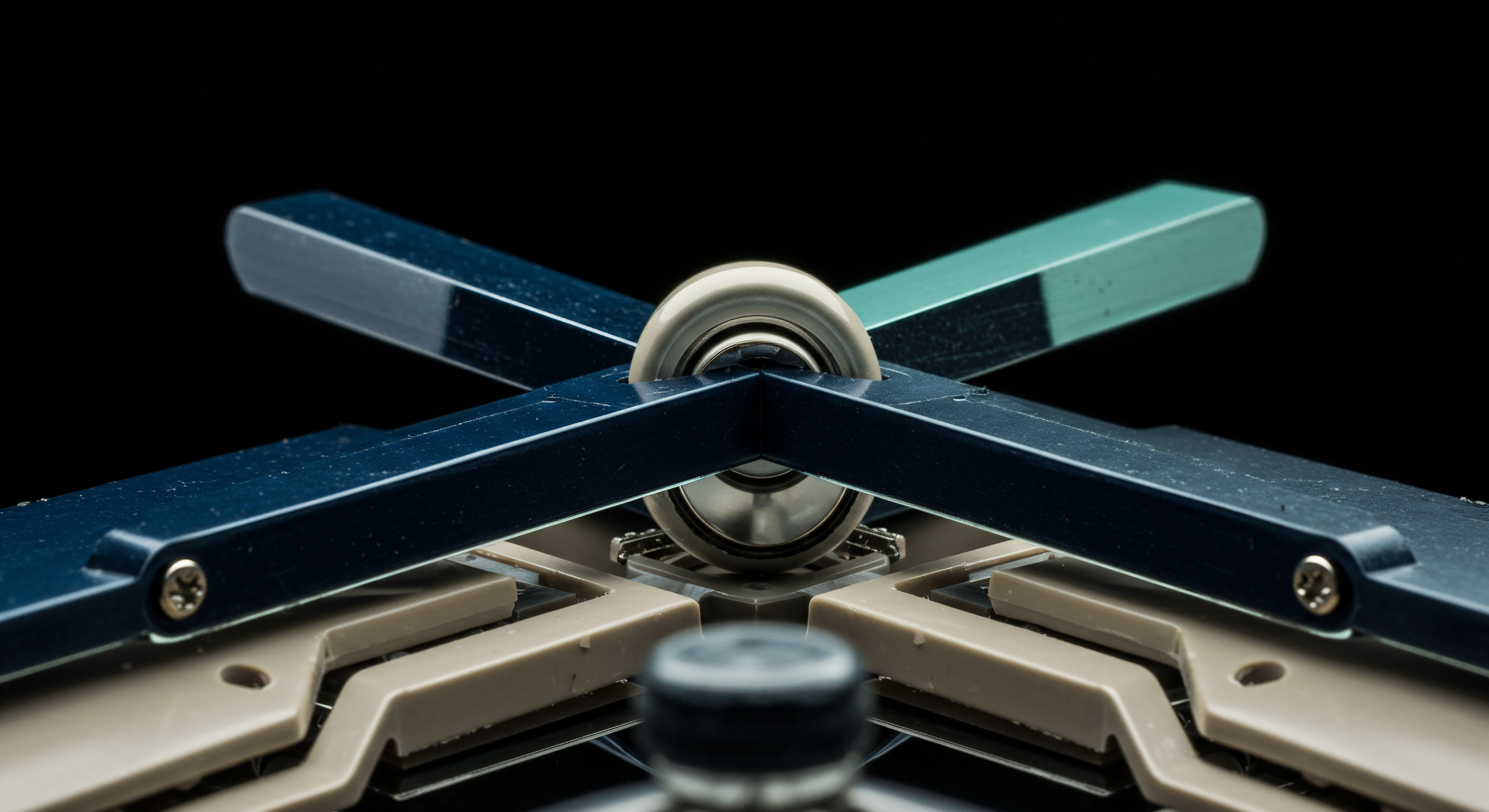

The execution layer for seamless cross-border block trade and compliance demands a granular understanding of operational protocols, technical standards, and the precise interplay of various systems. This is where strategic intent translates into tangible, verifiable outcomes, requiring a deeply researched and data-driven approach. The integration of distributed ledger technologies (DLT) and the Financial Information eXchange (FIX) protocol stand as cornerstones in this operational architecture, each addressing critical facets of efficiency, transparency, and compliance.

Distributed ledger technology, particularly blockchain, offers a transformative mechanism for cross-border settlement and reconciliation. By providing an immutable, shared record of transactions, DLT significantly reduces the need for costly and time-consuming manual reconciliation processes across different financial institutions and jurisdictions. The transparency inherent in a blockchain-based system facilitates real-time auditability, which is invaluable for meeting Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations across multiple legal frameworks. A DLT-based system can integrate smart contracts to automate compliance checks, triggering actions or notifications when predefined conditions are met, thereby reducing human error and expediting regulatory adherence.

Consider the operational flow of a cross-border block trade involving digital assets, where DLT can enhance efficiency at several stages.

- Pre-Trade Compliance Verification ▴ Before a trade is even initiated, smart contracts on a DLT can automatically verify the eligibility of counterparties against a global registry of approved entities, ensuring compliance with sanctions lists and jurisdictional restrictions. This preemptive screening minimizes the risk of executing non-compliant trades.

- Trade Execution and Immutability ▴ Once terms are agreed upon, the trade details are recorded on the distributed ledger. This record is cryptographically secured and immutable, providing an indisputable audit trail. This shared source of truth eliminates discrepancies that often arise from fragmented record-keeping systems.

- Atomic Settlement ▴ DLT enables atomic settlement, where the transfer of the asset and the corresponding payment occur simultaneously. This significantly reduces settlement risk, a persistent challenge in traditional cross-border transactions, especially across different time zones and payment infrastructures.

- Post-Trade Reporting and Audit ▴ The immutable ledger simplifies regulatory reporting. Regulators and compliance officers can access a verified, tamper-proof record of all transactions, reducing the burden of data aggregation and reconciliation for reporting purposes.

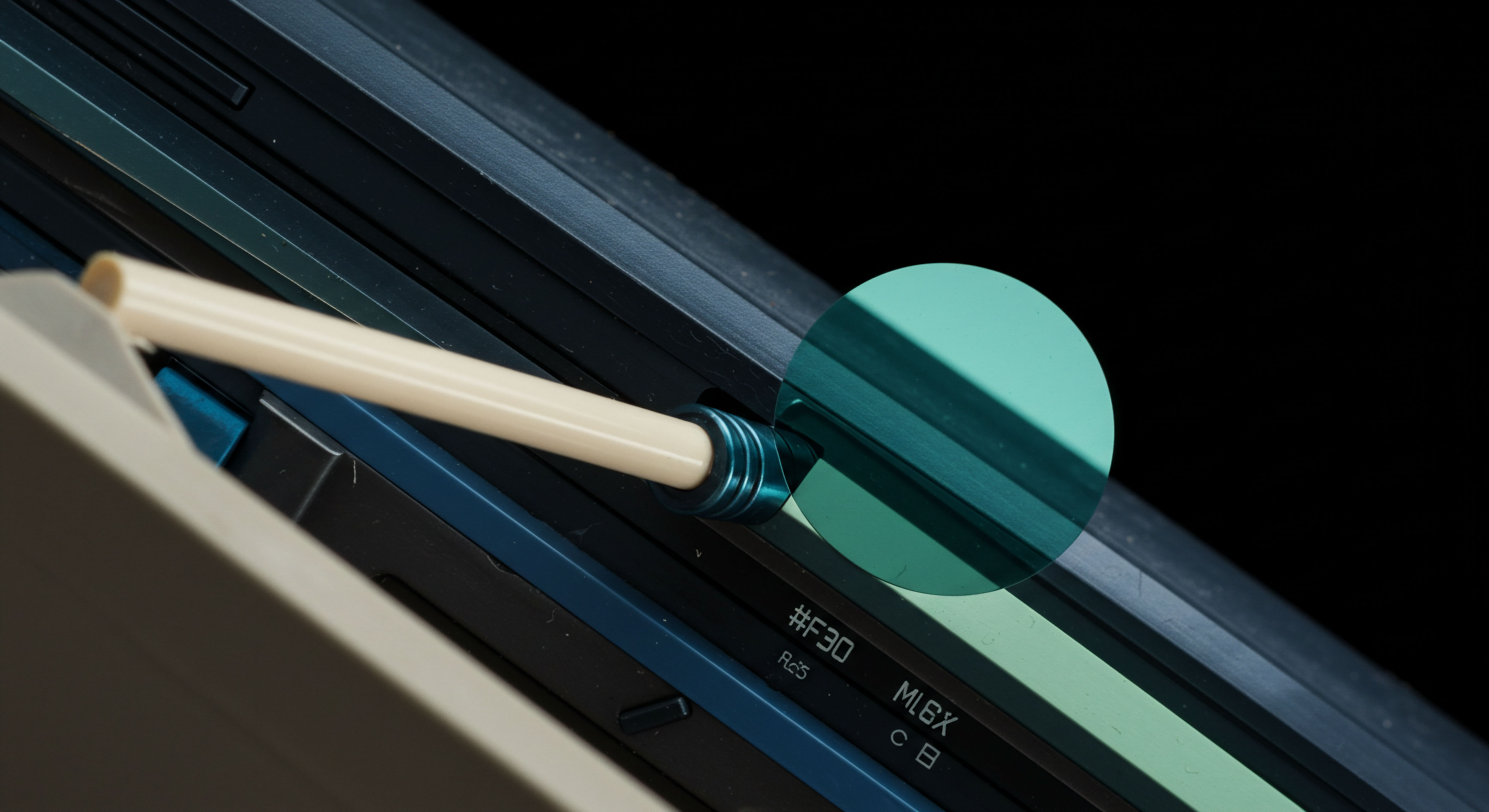

The Financial Information eXchange (FIX) protocol serves as the established communication backbone for electronic trading, extending its utility into the digital asset realm. FIX provides a standardized messaging layer that enables seamless communication between buy-side firms, sell-side brokers, exchanges, and other market participants. For cross-border block trades, FIX ensures that order routing, execution reports, and allocation messages are communicated consistently and efficiently, regardless of the underlying asset or geographical location. This standardization is critical for multi-venue trading strategies, allowing institutions to connect to diverse liquidity pools using a single, unified interface.

FIX protocol provides the standardized communication layer essential for efficient, multi-venue cross-border block trade orchestration.

A core benefit of FIX in this context lies in its support for pre-trade risk controls and post-trade compliance reporting. FIX messages contain detailed fields for capturing execution venue, timestamp, counterparty information, and order characteristics, all of which are vital for demonstrating best execution and fulfilling regulatory obligations. The protocol’s extensibility allows for adaptation to the specific nuances of digital asset derivatives, incorporating fields relevant to token identifiers, collateral types, and smart contract parameters.

The integration of FIX with DLT platforms represents a powerful synergy. FIX can facilitate the pre-trade and trade execution communication, while DLT handles the post-trade settlement and immutable record-keeping. This layered approach leverages the strengths of both technologies, creating an end-to-end solution that is both efficient and compliant. For instance, an RFQ for a large block of Bitcoin options might be initiated via FIX, with the executed trade then settled on a DLT network, providing instant, final settlement and an auditable record.

One must acknowledge the complex challenges inherent in such integrations, particularly the need for interoperability between disparate DLT networks and the harmonization of regulatory frameworks across jurisdictions. This visible intellectual grappling with the multifaceted nature of global financial infrastructure underscores the continuous evolution required to achieve true operational mastery.

The following table illustrates key performance indicators and their improvement through integrated technological solutions ▴

| Performance Metric | Traditional System Baseline | Integrated DLT/FIX System Target | Impact Factor |

|---|---|---|---|

| Settlement Latency | T+2 to T+5 days | Minutes to real-time (T+0) | ~99% reduction |

| Reconciliation Effort | High, manual, error-prone | Minimal, automated, immutable | ~80% reduction in operational cost |

| Compliance Audit Time | Weeks to months | Days to weeks | ~75% acceleration |

| Information Leakage Risk | Moderate to high | Low (private quotation protocols) | Significant reduction in market impact |

| Operational Risk | Susceptible to manual errors, fraud | Reduced through automation, immutability | Enhanced system resilience |

Achieving these target metrics demands a rigorous implementation strategy. This involves not only the technical integration of systems but also the establishment of robust governance models and the continuous monitoring of performance against predefined benchmarks. The ability to measure and quantify the impact of these integrations provides a feedback loop for further optimization, ensuring that the operational framework remains at the forefront of market innovation. A short, blunt sentence ▴ Precision dictates success.

References

- Zubair, Anoushka. “Blockchain Solutions for Secure Cross-Border Transactions.” ResearchGate, 2025.

- Gil Ríos, Olvis E. “Regulatory Compliance and Governance Model for Cross-Border Payments Using Blockchain Technology.” BlockStand, 2024.

- Lee, Micheal. “Cross-Border Payments and Settlement Efficiency through Blockchain-Based Trade Finance Systems.” ResearchGate, 2025.

- Fink, Fabian, Thomas Maag, and Alexander Wehrli. “Digital Asset Market Structure ▴ Lessons From and For the Institutional Foreign Exchange Spot Market.” Swiss National Bank, 2023.

- Easthope, David. “Digital Asset Market Structure ▴ Institutions Take the Reins.” Coalition Greenwich, 2022.

- Yacoubian, Raffi, et al. “Market Microstructure of Cryptocurrency Exchange ▴ Order Book Analysis.” ResearchGate, 2025.

- FIX Trading Community. “FIX Protocol in Crypto Trading ▴ Why Institutions Still Use It.” FinchTrade, 2025.

- International Monetary Fund. “Distributed Ledger Technology Experiments in Payments and Settlements.” IMF eLibrary, 2020.

- Federal Reserve Board. “Distributed Ledger Technology in Payments, Clearing, and Settlement.” Federal Reserve Board Publications, 2016.

Evolving Operational Command

The journey through the technological integrations underpinning seamless cross-border block trade execution and compliance ultimately reveals a fundamental truth ▴ operational excellence stems from systemic foresight. This exploration extends beyond mere technological adoption; it compels a re-evaluation of an institution’s entire operational framework. Consider the intrinsic value of an immutable ledger or the standardized language of a communication protocol. These elements, when harmonized, form a formidable defense against market friction and regulatory complexity.

Reflect on your own operational blueprint. Are your systems merely reacting to market demands, or are they proactively shaping your strategic advantage? The integration of DLT, advanced RFQ mechanics, and the FIX protocol creates a synergistic effect, elevating execution quality and strengthening compliance postures.

This is not a static state but a continuous cycle of refinement and adaptation. The market, in its ceaseless evolution, rewards those who view their operational architecture as a living, breathing entity, constantly optimized for peak performance.

Cultivating Adaptive Market Systems

The ability to cultivate adaptive market systems represents the pinnacle of institutional sophistication. Such systems, designed with a modularity that permits rapid integration of emerging technologies, inherently possess a strategic advantage. This agility allows institutions to capitalize on new liquidity pools and navigate evolving regulatory landscapes with greater confidence. The imperative to integrate, to standardize, and to intelligently automate defines the current epoch of institutional trading.

Forecasting Future Execution Paradigms

Looking ahead, the convergence of artificial intelligence with these integrated systems promises further advancements in predictive analytics and autonomous execution. The goal remains consistent ▴ to achieve a decisive operational edge through a superior framework of intelligence and control. Your capacity to understand and implement these technological integrations directly correlates with your institution’s ability to thrive in an increasingly interconnected and complex global financial ecosystem.

Glossary

Cross-Border Block Trade

High-Fidelity Execution

Digital Asset

Distributed Ledger

Risk Management

Cross-Border Block Trade Execution

Seamless Cross-Border Block Trade

Distributed Ledger Technology

Cross-Border Settlement

Cross-Border Block

Smart Contracts

Trade Execution

Atomic Settlement

Digital Asset Derivatives

Block Trade